3-Step Formula to Estimate Cost per Meter

Cover gauge sets the rubber multiplier

Compound grade locks the fabric factor

Carcass type finalizes the price

1.Rubber Conveyor Belt Price per Meter: 1-2-3 Formula

You’ve lined up three quotes for the same 1 000 mm belt and—boom—each supplier fires back a wildly different number. Sound familiar? If you’re the one who signs the purchase order, you don’t care about the factory’s cost ledger; you care about the price that hits your budget today. Just as my last piece gave you a flash-fast way to estimate belt weight, this article hands you an equally sharp shortcut for nailing the rubber conveyor belt price per meter before the salesperson even finishes their pitch.

Here’s your stick-on-the-monitor cheat sheet:

1-glance at cover gauge sets the rubber multiplier.

2-quick questions—compound grade and carcass type—lock the fabric factor.

3-second lookup on your phone multiplies the two numbers into a tight ±5 % price range.

No jargon, no fluff—just a punchy formula you can use the next time someone asks, “What’s your budget?”

2.Rubber Conveyor Belt Price Per Meter: What It Really Means

When you ask a supplier “rubber conveyor belt price per meter,” you’re not asking for their production costs, but for the number that will end up on the invoice, shipping terms, and profit margin. Although it’s counter-logical, all sales will tell you is what their costs are and there is no profit.

Here’s a quick and clear checklist to pull out the next time a price discussion veers off topic:

2.1 Avoid talking about costs.

Costs are inside the factory; prices are what you pay. If a sales rep starts explaining raw rubber futures or labor costs, steer them back to the meter price that fits your budget.

2.2 Separate price units.

- Per meter – best for short or mixed-length orders.

- Per roll – for full rolls where you need 200-300 meters.

- Per ton – only useful if you’re buying scrap or used stock by weight.

Mixing the two quotes is the quickest way to get apples and oranges quotes.

2.3 Watch out for “additional” charges.

“Meter price” can imply import duties, trimming fees, and even pallet fees. Ask the supplier to specify whether the price is bare belt ex-works, FOB port or DDP – then compare apples to apples.

2.4 Cross-check with weight.

Refer to the weight quick check in our previous article and multiply the theoretical belt mass by today’s compound price per kg. If that number is far from the quoted metre price, it indicates a hidden mark-up or insufficient thickness.

Follow these four sanity checks and you’ll keep every conversation focused on the numbers that matter – the actual cost of a usable metre, now, in black and white.

3.Core Factors That Drive Your Per-Meter Quote

Before you haggle the rubber conveyor belt price per meter, you need to know what dials suppliers twist to move that number up or down. Think of the following four levers as the “price DNA” embedded in every quote you receive. Master them and you’ll predict the final figure before the salesperson reaches for their calculator.

3.1 — Compound Grade: The Chemistry Multiplier

As mentioned in previous articles, every conveyor belt starts with a rubber formulation, and every tweak to the chemical composition affects the price. Natural rubber, in particular, is an internationally traded futures commodity, and these are the factors that ultimately affect the price of rubber conveyor belts.

General-purpose rubber compounds can keep prices low, but if you switch to wear-resistant rubber conveyor belts, the price will immediately increase by 10–15%. Flame-retardant rubber conveyor belts will increase prices by another 5–12%, because the fire-retardant additives are imported and the curing process is very energy-intensive. If you use heat-resistant compounds, the price will increase further – if your kiln line runs at 200 °C, expect a further price increase of 20%.

The key question is: does the extended service life offset the premium? If your plant’s average DIN X wear loss is less than 120 mm³/year, then the upgrade will usually pay for itself within six months. Do the math once, make the decision, and don’t let “one size fits all” become an expensive habit.

3.2 — Cover Gauge: Millimeters That Multiply Money

Those seemingly tiny 1 mm jumps in cover thickness hide a nasty surprise: price escalates exponentially because rubber is the single most expensive ingredient. A standard 4 + 2 mm profile keeps things light, but a rubber conveyor belt 6 + 2 mm thickness price adds roughly 8 – 10 % per meter. Step up to an 8 + 3 mm quarry spec and you’re paying 18 – 25 % more than baseline.

That jump matters most when you order widths above one meter, because surface area explodes your rubber volume. Use the quick thumb rule: for every millimeter added to both covers, tack on 7 % of base price and multiply by belt width in meters. You’ll sniff out padding fast and defend your spec with math, not guesswork.

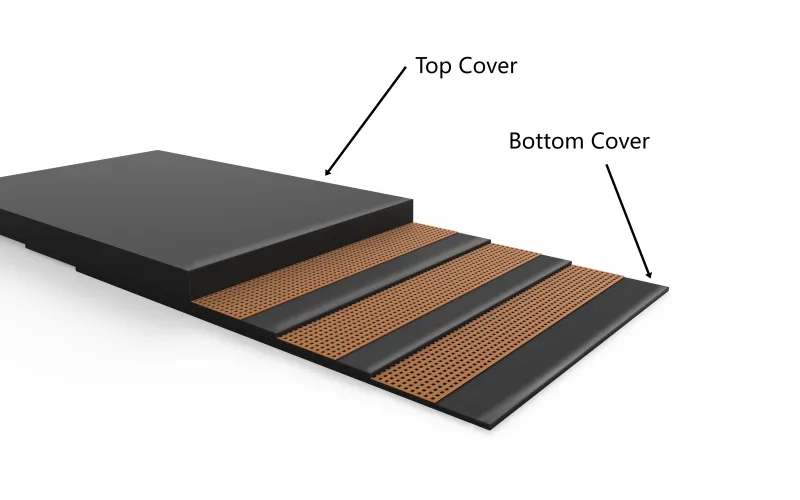

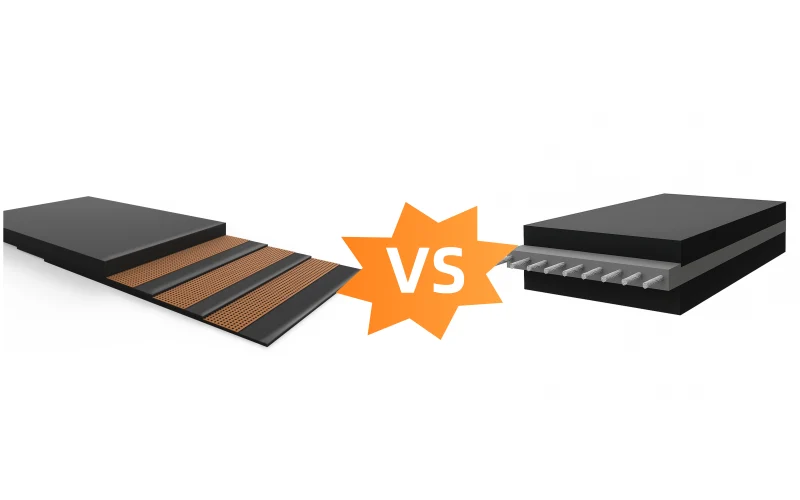

3.3 — Carcass Architecture: Fabric vs. Steel Tug-of-War

Carcass choice is the heaviest lever of all. An EP carcass remains the global benchmark; check any catalogue and you’ll see the EP conveyor belt price column smack in the middle. Want more flex and impact resistance? The NN conveyor belt cost per meter runs 6–8 % higher but stretches fatigue life on crusher drops by a quarter. Craving raw tensile muscle for a long downhill? A steel cord means you’re browsing ST conveyor belt price per meter lists—30 % above EP for the same width. Need a budget-friendly dock belt? An EE conveyor belt price range often undercuts EP by two to three dollars.

Match that architecture to load and distance: a 1000 mm EP400 conveyor belt cost per meter suits a cereal plant, while a 1200 mm ST1250 conveyor belt price per meter is the only sane choice for a 3 km iron-ore line.

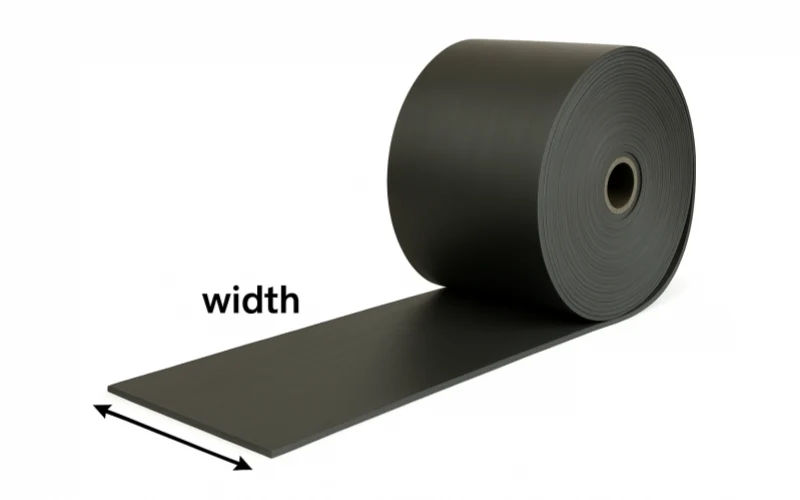

3.4 — Belt Width & Smart Extras: The Hidden Stretch

Width is a straight linear driver—double the width, double your rubber bill. An 800 mm rubber conveyor belt price looks lean until you add anti-rip sensor loops, hot-vulcanized edges, or cold-weather compounds.

Each “yes” tacks on 5–12 %. Buying by the roll? Quote suppliers in full-coil lots and you unlock bulk-roll rubber conveyor belt wholesale price breaks of 3–5 %. Demand DIN X abrasion resistance or USDA-approved white covers and watch another 7 % slide into the equation. The takeaway: list every add-on in writing, then request a per-item surcharge. You’ll keep upgrades visible and stop scope creep from draining your cap-ex budget.

Your Quick Recap: Pick compound first, set the gauge second, lock carcass third, and adjust width plus options last. Treat those steps like layers in a cake: cheaper flour on top won’t hide burnt sponge beneath. Nail the order and suppliers start competing on efficiency, not on how well they can blur the spec sheet.

4.Typical Specs & Live Reference Prices

Nothing is more useful than a reality-check list that shows what one meter should cost right now. The figures below merge Q2 2025 mill and trader offers—originally gathered around Shanghai and adjusted to FOB Ningbo with port surcharges, export packing, and a ±5 % exchange-rate buffer already baked in—so you can benchmark any rubber conveyor belt price per meter a supplier throws at you. Treat these ranges as hard guardrails: if a quote lands far outside them, pause the conversation and dig for the reason before you sign.

4.1 800 mm / EP315 × 4 ply / 6 + 2 mm — light quarry & dock work

Public listings from Ningbo mills cluster at US $25–30/m for plain DIN Y stock.In practice, you’ll pay US $33–42/m once you upgrade to DIN X abrasion rubber and add hot-vulcanized edges. Order a full 250 m coil and most factories shave off about US $1.50 per meter. Anything above US $45/m is either overspec’d compound or sales padding—push back.

4.2 1000 mm / EP400 × 4 ply / 6 + 2 mm — Factory transfer staple

For this mainstream width the EP conveyor belt price has settled at US $41–56/m. The low end assumes DIN Y and ex-works pickup; add USDA-white covers or FDA paperwork and you’ll nudge US $60. Lock in ≥600 m and suppliers typically rebate 3 %. Quotes under US $38 usually mean thickness is shy of the stated 6 + 2 mm—ask for a factory weigh-ticket.

4.3 1200 mm / ST1250 / 8 + 3 mm — long-haul mining heavyweight

Steel-cord offers start around US $30–35/m at the 1 000 mm width for MOQ 20 m. Scale that to 1 200 mm and factor the heavier 8 + 3 mm covers, and real steel cord conveyor belt cost per meter lands between US $72–90/m. Add embedded anti-rip loops and you’ll kiss US $95. If a seller pitches < US $65, they’re thinning cord diameter—demand the tensile report.

4.4 1000 mm / NN400 × 4 ply / 6 + 2 mm, Grade-A reclaimed

Used-belt traders list Grade-A stock at US $29–30/m for 1 000 mm widths.

After edge trimming, splice prep, and a pull-test, landed price averages US $27–33/m—about 35 % under new NN. Factor in 10–12 % length loss and an abbreviated warranty; the true saving nets closer to 18 %. If the delta is smaller, you’re better off ordering fresh EE fabric for reliability.

How to use this sheet: keep it taped to your monitor, jot the spec the moment a quote arrives, and see where the number sits. Outliers aren’t always wrong—but they always deserve a follow-up call.

5. Raw-Material & FX Whiplash: Why Today’s Quote Might Change Tomorrow

If the spec sheet sets the baseline, raw-material markets and currency swings decide whether the rubber conveyor belt price per meter you lock in today still looks smart next quarter. Ignore them and that “best” deal can flip to budget-buster before the first roll ships.

5.1 Natural rubber: the roller-coaster you can’t exit

The compound in every belt starts with RSS-3 sheets or SCR-WF blocks, both priced off Singapore and Shanghai futures. In Q2 2025 RSS-3 spiked to 233 ¢/kg on 22 May, then slid to 216 ¢/kg by 8 June—a 7 % drop in just 17 days. Two months earlier a weather-driven rally added 11 % in a single April week. That volatility translates almost one-for-one into mill offers: every 10 ¢/kg swing nudges your meter price by roughly US $1.20 on a 1 000 mm, 6 + 2 mm belt. Knowing the natural rubber price impact on conveyor belt cost lets you time purchases—book when futures dip below their 20-day average and insist on a “rubber escalator” clause so suppliers rebate if prices soften before production.

5.2 Carbon black: slower moves, still a budget lever

N330 spot in Shandong held RMB 6 500–7 000/t through April–May but analysts flag supply-chain flare-ups can add US $40–60/t overnight . Carbon black is 25–30 % of a wear-resistant rubber mix, so a US $50/t rise means ~US $0.70/m on your wear-resistant rubber conveyor belt price. When quotes arrive, ask which grade (N330 vs. N550) they priced in; swapping to a softer, cheaper grade for non-abrasive applications can claw back 2–3 % of total spend.

5.3 Yuan vs. Dollar: the silent surcharge

Belts are costed in RMB but quoted to you in USD FOB Ningbo. The CNY/USD pair has traded between 0.1361 and 0.1395 in 2025—a 2.5 % band. A ¥0.003 shift sounds tiny yet adds US $1.50/m on a steel-cord spec. Banks like JPMorgan now see the yuan firming toward 7.15 CNY per USD by year-end (≈0.1399 USD/CNY), so dollar-denominated quotes could edge higher as Chinese mills protect margin.

5.4 Quick hedging playbook for you

- Dual-currency clause:peg 70 % of the order in USD, 30 % in RMB; whichever legs higher, you’re partly shielded.

- Raw-material trigger band:agree that if RSS-3 moves ±8 % between PO and production start, price resets mid-cycle.

- Quarterly call-offs:split annual volume into four orders—buy heavy when rubber and FX dip, feather when they spike.

Run those levers and you stay ahead of every seesaw the market throws at you—even before the supplier’s Monday-morning price sheet hits your inbox.

6.New vs Second-Hand: Which Rubber Conveyor Belt Price per Meter Really Saves You?

You spot a tempting offer: “Grade-A reclaimed belts, 35 % cheaper!” But before you rush that purchase order, weigh the full equation—because the headline rubber conveyor belt price per meter tells only half the story.

6.1 Sticker Price vs True Spend

- New stock: a 1 000 mm EP400, 6 + 2 mm DIN Y spec ships FOB Ningbo at about US $45/m.

- Reclaimed stock: the same width and strength shows up on a trader’s list at US $30/m. On paper, your meter price plunges 33 %.

Yet freight forwarders still invoice by weight, not discount; your ocean cost per ton barely moves. Factor that in and the apparent gap shrinks to 24 %.

6.2 Hidden De-Rating

A second-hand belt rarely keeps its full 6 mm cover. Edge wear plus surface gouges knock off 0.8–1.2 mm. With rubber as the cost driver, that missing millimetre already explains half the discount you thought you “won.” Worse, tensile strength drops 10–12 % after two years of flexing. If you’re planning a 600 m run, derate the working load—or budget for splices when those old edges split.

6.3 Inspection & Prep Costs

- Pull test(ISO 283) US $280 per batch

- X-ray cord scan(for steel-cord lots) US $0.80/m

- Edge re-trim + re-vulcanise ≈ US $3 – 4/m

Add those numbers and your “second-hand rubber conveyor belt cost comparison” tightens again: effective out-the-door price climbs to US $35 – 38/m—just 15 % below a brand-new roll, not 35 %.

6.4 Warranty & Uptime Delta

New belts carry a 12-month splice-to-splice warranty and predictable shutdown windows. Reclaimed belts offer 30 days at best. If an unplanned break halts a 400 t/h conveyor for four hours, lost throughput dwarfs the US $7/m headline saving in one afternoon.

Rule of Thumb: If your line runs fewer than 1 000 hours a year, reclaimed can make sense. Above that, the safer rubber conveyor belt price per meter is almost always the new one—because hidden downtime costs never show on a quote sheet, but they hit your P&L like a dropped drive drum.

7.Volume Buying & Negotiation Playbook

Ordering ten meters here, fifty meters there will keep your maintenance team happy—but it will keep your margin thin. Below is a practical framework for squeezing every possible cent out of your next order while the rubber conveyor belt price per meter is still on the table.

7.1 Know the “step curve” before you ask for quotes

Most Ningbo mills publish three invisible break-points:

- 200 m – the first price dip (usually –3 %).

- 500 m – the sweet spot where the factory can run a full shift without cleaning the calender (another –4 %).

- 1 000 m – the point at which raw-rubber batching, edge-trimming and palletising are all continuous (total –8 % to –10 %).

Walk in asking for a 180 m coil and you’ll pay list price plus a cutting surcharge; walk in at 210 m and you unlock the first discount tier with the same paperwork.

7.2 Combine SKUs across lines

If Line A needs a 1 000 mm EP400 and Line B needs an 800 mm EP315, negotiate the wider belt first, then ask the factory to slit the excess width into smaller rolls. Material yield improves and you’re effectively buying two specifications on one production run. The result: a blended bulk roll rubber conveyor belt wholesale price that undercuts standalone quotes by 4–6 %.

7.3 Swap length risk for unit savings

Factories hate trimming odd lengths because they can’t resell the off-cuts. Offer to take full 280–300 m “master coils” and splice on site; most suppliers will shave 1 % just to avoid the extra knife work. Time the splice during your scheduled shutdown and that concession drops straight to the bottom line.

7.4 Quarterly call-offs beat annual blanket POs

Rubber and FX both move fast; agreeing to four equal call-offs lets you refresh price bands every three months while still guaranteeing the seller predictable volume. Include a ceiling clause (e.g., “not to exceed +4 % over Q2 basis”) and you capture upside if RSS-3 plunges without absorbing the full hit when it spikes.

7.5 Leverage the real container limit

A 20-foot box FOB Ningbo tops out at 27 t of EP belt (my record load was 26.8 t—barely cleared the pier, verified export weight). Over-weight? Vessel operator rejects the booking. If your order fills only 60 % of that cap, ask the supplier to arrange an LCL consolidation or load Chinese-sourced spares in the same box. Consolidation typically saves US $200–300; on niche trade lanes the freight bill can plunge even further.

Lock these tactics into your RFQ template and you’ll shift the conversation from raw-material excuses to hard, defensible volume rebates—turning every extra meter you buy into pure negotiated profit.

8.Quick-Fire Summary & Selection Cheat Sheet

You’ve waded through gauges, grades, and freight tactics—now distill it to one pocket card you can whip out in the next budget meeting. Remember, you chase a single number: rubber conveyor belt price per meter.

8.1 Four-Line Mnemonic

- Width sets the cost.Double the width, double the spend—linear, predictable.

- Thickness buys life.Each extra millimetre of cover adds ~7 % price, ~15 % wear hours.

- Carcass selects the arena.EP for general duty, NN for impact, ST when tension rules, EE if cash is tight.

- Extras write the fine print.Anti-rip loops, hot edges, fire-safe mixes: every tick adds 5–12 %.

8.2 Rapid-Fire Recommendations

Scenario | Best Pick | Why it wins |

Budget-conscious plant transfer | EP400, 6 + 2 mm, DIN Y | Solid flex life, cheapest chemistry. |

Crusher drop zones, heavy impact | NN400, 6 + 2 mm, DIN X | Nylon–Nylon carcass absorbs shock; wear rubber lasts 25 % longer. |

Long-haul (>1 km) ore run | ST1250, 8 + 3 mm, DIN X | Steel cord keeps splice tension flat; thicker covers outrun maintenance. |

Short dock belt, tight purse | EE350, 4 + 2 mm, DIN Y | Lowest ply cost with enough flex for slow speeds. |

8.3 Action List

- Fix your spec first—never negotiate price on a moving target.

- Use the 60-second formulato flag padding before formal RFQ.

- Lock volume tiers(200 m / 500 m / 1 000 m) into the contract.

- Set raw-material trigger bandsso futures spikes don’t nuke margins.

Carry this playbook, and the next quote thread shifts from “What do belts cost?” to “Here’s what we’ll pay—and why.”

9. Frequently Asked Questions (FAQ)

Below are the five issues procurement teams ask me most often when they’re hunting for the best rubber conveyor belt price per meter. Keep this page handy; it turns hallway debates into quick, data-backed decisions.

1. How big is the price gap among EP, NN, ST and EE belts of the same width?

Expect EP to anchor the quote sheet. NN runs about 6–8 % higher because the nylon-nylon carcass absorbs impact and resists gouging. EE, with its polyester warp and weft, usually sits 2–3 % below EP—handy for low-tension, low-budget lines. Steel-cord ST belts, however, leap 28–35 % above EP; you’re paying for tensile muscle and splice stability over kilometres, not for day-one sticker shock.

2. If I add 1 mm of cover, how much does the meter price rise?

Rubber drives cost more than fabric, so each extra millimetre on both covers adds roughly 7–10 % to the meter price. For example, moving from 6 + 2 mm to 8 + 3 mm on a 1 000 mm belt can push a US $50/m quote up to US $58–55/m, depending on compound grade. Balance that bump against maintenance savings: thicker covers often stretch service life 15 % or more in high-abrasion environments.

3. Raw-material prices just spiked—how do I keep quotes under control?

Lock in a “rubber escalator” clause pegged to RSS-3 futures. Negotiate a trigger band—say ±8 % of today’s contract price—so if natural rubber retreats after you place the PO, the supplier rebates the delta; if it rises, you split the difference. Pair that with quarterly call-offs instead of a single annual order, and you’ll refresh pricing four times a year while guaranteeing the mill predictable volume.

4. Can I simply discount a second-hand belt by the remaining thickness?

Thickness matters, but tensile fatigue and edge damage matter more. A reclaimed EP belt that has lost 15 % of its cover may have also lost 10–12 % of its rated strength. After lab pull-tests, trimming, and re-vulcanising edges (about US $3–4/m), the true saving narrows to 15–18 % over new stock—not the headline 35 % traders advertise. Always budget inspection costs before celebrating the discount.

5. How do I verify a supplier isn’t shaving gauge or fabric count?

Weigh the entire roll on arrival, multiply width by theoretical weight per meter (from the formula in Section 5), and compare. A 3 % deficit screams under-thickness. For fabric counts, core-shoot a 150 mm strip and physically separate the plies; four layers should mean four fabric sheets plus two cover slabs. Finish by checking batch numbers on the splice tags—mismatches often flag swap-outs of cheaper carcass stock.