If you’ve ever struggled to figure out the right conveyor belt hs code, you’re not alone. Many exporters and importers waste time and money simply because rubber and PVC belts are classified differently. In this article, I explain the codes step by step, backed by real trade rules and country-specific formats, so you won’t get lost in digits again. By the end, you’ll know exactly how to match your product with the right code and avoid customs headaches in future shipments.

1.Why Finding the Right Conveyor Belt HS Code Matters

Since you opened this blog, I can safely guess you are dealing with a problem related to the conveyor belt HS code. Maybe you are preparing export documents and don’t know whether to use the rubber conveyor belt HS code or the PVC conveyor belt HS code. Or maybe your shipment was flagged at customs, and now you are searching for the right classification to avoid another delay. Either way, you’ve landed in the right place.

In international trade, the HS Code—short for Harmonized System Code—is more than just a number. It is the “passport” of your product. Customs authorities worldwide rely on it to decide how much duty you should pay, whether your goods can pass clearance, and even how your product shows up in trade statistics. According to the World Customs Organization (WCO), over 98% of global trade is classified under the HS system (WCO source). That means, if your HS code for conveyor belt is wrong, customs will notice.

And when customs notice, the consequences are rarely small. At best, you’ll face a delay of a few days; at worst, your container sits in port storage while inspectors open it, check samples, and reclassify the product. Every hour lost adds cost—and damages your reputation with buyers who expect on-time delivery. I’ve seen companies lose contracts simply because their belts were misdeclared.

This is why selecting the correct conveyor belt HS code is not just a formality. It’s a business-critical step that protects your margins, your schedule, and your credibility. In this guide, we’ll go beyond the basics and look closely at how rubber conveyor belt HS codes and plastic conveyor belt HS codes like PVC are defined, why different countries may treat them differently, and how you can avoid common mistakes in classification.

2.Global HS Code System Overview

When you search for the conveyor belt HS code, it’s easy to expect a single, universal number. In reality, the HS system is layered, and understanding its structure is the only way to classify products like rubber conveyor belts or PVC conveyor belts correctly.

2.1 The Global Rule: First Six Digits

The HS Code, short for Harmonized System Code, is designed so that the first six digits are the same worldwide. These six digits identify the product family, whether you are shipping to China, the United States, or Europe. After those six digits, each country adds its own numbers—two, three, or even four extra digits—for tariff and regulatory purposes. That’s why the United States uses 10-digit HTSUS codes, the European Union has 8-digit CN codes, Japan uses 9 digits, and China often extends to 13 digits.

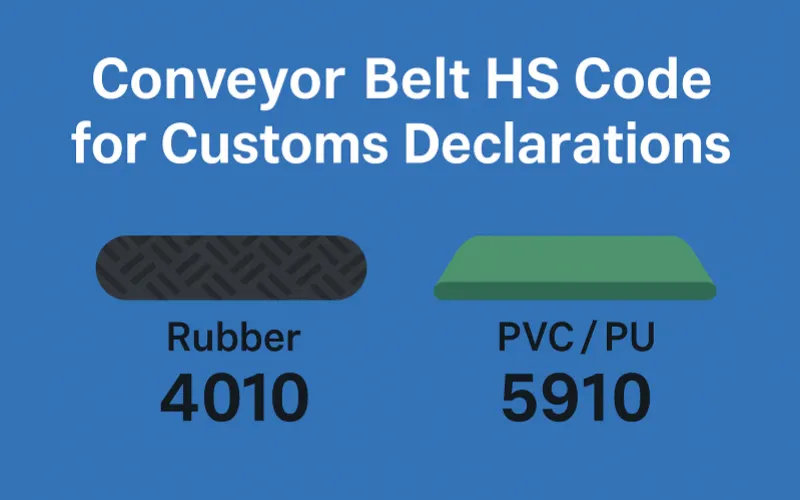

For conveyor belts, two HS chapters are most important: Chapter 40 for rubber and Chapter 59 for coated textile belts.

2.2 Step-by-Step Breakdown of Conveyor Belt Codes

Let’s look at how the numbers break down, two digits at a time.

2.2.1 Rubber Conveyor Belts → 4010

- 40→ Chapter 40: Rubber and articles made of rubber.

- 10→ Heading 4010: Conveyor or transmission belts, of vulcanized rubber.

- 11→ Subheading: Metal-reinforced rubber conveyor belts.

- 12→ Subheading: Textile-reinforced rubber conveyor belts.

- 19→ Subheading: Other vulcanized rubber conveyor belts.

This is the standard rubber conveyor belt HS code used worldwide as the foundation.

2.2.2 PVC / PU Conveyor Belts → 5910

- 59→ Chapter 59: Impregnated, coated, or laminated textile fabrics.

- 10→ Heading 5910: Transmission or conveyor belts of textile material, coated or covered with plastics.

- 00→ Subheading: The universal PVC conveyor belt HS code (also used for PU belts).

Here the focus shifts: customs sees PVC belts not as “plastic goods” but as textile belts with a plastic coating. That’s why the classification starts in Chapter 59, not in the plastics chapter.

2.3 The Classification Logic

The real key is how customs interprets the essential material. If the belt is mostly rubber, it falls under 4010. If it’s primarily a textile carcass coated with PVC or PU, it goes under 5910.

This structure looks straightforward, but the challenge usually comes in the extra digits beyond the first six. Globally, a textile-reinforced rubber conveyor belt will always belong under 4010.12. What changes is how countries expand the code. For example, the United States might extend it to 4010.12.9000, while China uses 4010120000, and the EU applies 4010 12 00.

So, the classification principle is consistent worldwide—rubber stays in 4010, PVC and PU stay in 5910—but the national extensions create differences in format and tariff application. This is why exporters often feel confused when comparing documents across countries: the code looks longer or shorter, yet the base classification remains the same.

2.4 Practical Advice for Exporters and Importers

Instead of memorizing numbers blindly, learn to read the HS code structure:

- If it starts with 40, think rubber.

- If it starts with 59, think textile with plastic coating.

This simple check saves time when preparing documents. More importantly, always list the belt’s material and reinforcement method in contracts and invoices—e.g., “textile-reinforced rubber conveyor belt” or “PVC-coated textile belt.” This reduces the chance of customs officers questioning your classification and avoids costly inspections.

Understanding the layered system gives you confidence to declare the right conveyor belt HS code, no matter which market you are shipping to.

3.Rubber Conveyor Belt HS Code

Rubber conveyor belts are the workhorses of industries such as mining, steelmaking, ports, and power plants. In customs classification, they all fall under HS Code 4010, but within this heading, there are three major subcategories: 4010.11, 4010.12, and 4010.19. The deciding factor for classification is the reinforcement material inside the belt, which forms the carcass and provides its mechanical strength.

The carcass can be built with steel cords, textile fabrics, or high-performance aramid fibers. These materials are arranged in the warp (lengthwise) and weft (crosswise) directions, and their properties directly affect the belt’s performance. Customs authorities focus on these reinforcement structures when assigning the correct HS Code.

3.1 Global 6-Digit Code with Product Categories

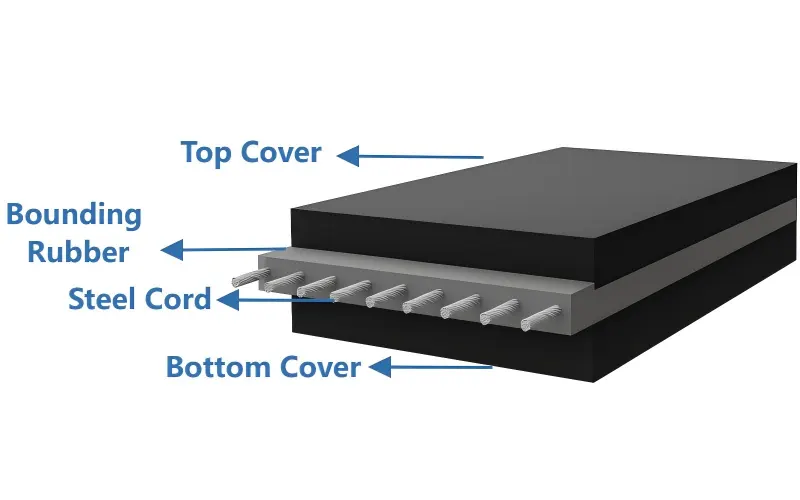

4010.11 – Metal-Reinforced Rubber Conveyor Belts

This group covers conveyor belts reinforced with steel cords. The cords run lengthwise through the belt and are embedded in rubber, forming a carcass that delivers extreme tensile strength and minimal elongation.

- Warp (lengthwise): Steel cords, aligned in parallel. They give the belt the strength to carry heavy loads over long distances without stretching.

- Weft (crosswise): In some belts, a thin layer of fabric or rubber is used to stabilize the cords. In other designs, no weft is added at all, and the belt relies solely on the steel cords.

This structure makes ST Conveyor Belts (Steel Cord Belts) the standard choice for long-distance conveyors in coal mines, iron ore handling, and bulk terminals. Their ability to transport materials across kilometers with minimal stretch is the reason customs classify them under 4010.11.

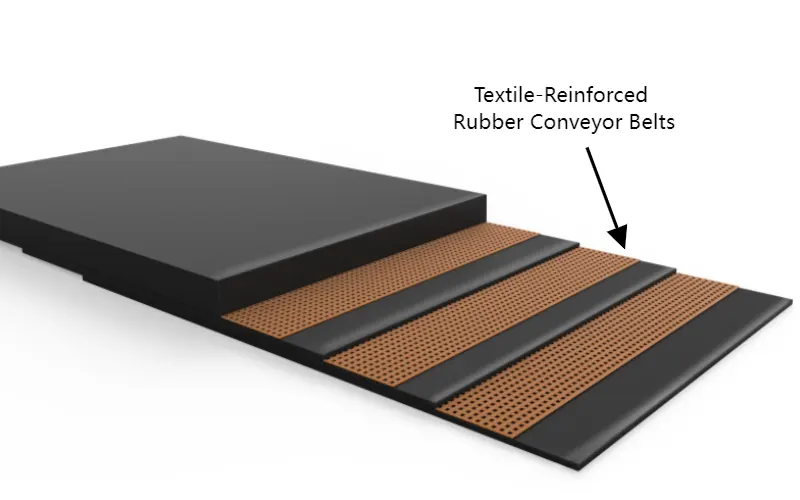

4010.12 – Textile-Reinforced Rubber Conveyor Belts

This is the most widely used group of rubber conveyor belts. Instead of steel, they use woven fabric layers for reinforcement. Each fabric ply has warp and weft yarns chosen to balance stability and flexibility.

①EP Conveyor Belts (Polyester/Nylon)

- Warp (lengthwise): Polyester,which has low elongation and keeps the belt dimensionally stable.

- Weft (crosswise): Nylon, which provides elasticity and absorbs impacts.

Together, this construction makes EP belts strong yet resilient, ideal for medium- to long-distance conveying where the belt must stay stable but also flexible under dynamic loads.

②NN Conveyor Belts (Nylon/Nylon)

- Warp (lengthwise): Nylon.

- Weft (crosswise): Nylon.

With nylon in both directions, these belts are highly elastic and flexible. They are best suited for short-distance conveyors with heavy impacts, such as loading stations, where shock resistance matters more than low elongation.

③SW Conveyor Belts (Straight Warp)

- Built with straight warp fabric, where strong warp yarns run parallel without crisscrossing.

- The simple but robust structure gives outstanding tear resistance.

These belts are commonly used in quarries and aggregate industries, where sharp rocks and heavy impact loads require maximum durability.

④CFW Conveyor Belts (Crawford Weave)

- Reinforced with a special Crawford weave, where warp and weft interlace tightly.

- This dense weave provides superior stability and resistance to tearing.

They are used in demanding environments where belts must maintain integrity under continuous heavy loads.

All of these textile-reinforced designs belong under 4010.12, because their essential reinforcement is fabric rather than metal.

4010.19 – Other Vulcanized Rubber Conveyor Belts

This category is reserved for belts reinforced with materials that are neither steel nor conventional textiles. The best example is the Kevlar Conveyor Belt, also known as aramid-reinforced belts.

- Warp (lengthwise): Kevlar fibers, which are lighter than steel but nearly as strong. They resist stretching while reducing the overall weight of the belt.

- Weft (crosswise): Kevlar or aramid blends, adding stability and extra resistance to tearing.

By combining light weight with high tensile strength and excellent heat resistance, Kevlar belts can operate in extreme conditions where steel or nylon belts would fail. They are widely used in high-temperature applications and specialized conveying systems, which is why customs assign them to 4010.19.

3.2 Country-Specific Classifications

Although the global 6-digit structure is consistent, each country expands the HS Code differently for tariffs and statistics:

- China→ 4010110000 (ST), 4010120000 (EP, NN, SW, CFW), 4010190000 (Kevlar).

- United States (HTSUS)→ 4010.11.5000 / 4010.12.9000 / 4010.19.0000.

- European Union (CN Code)→ 4010 11 00 / 4010 12 00 / 4010 19 00.

- Japan→ 4010.11.010 / 4010.12.010 / 4010.19.090.

- India→ 4010 11 00 / 4010 12 00 / 4010 19 00.

- Brazil (Mercosur NCM)→ 4010.11.00 / 4010.12.00 / 4010.19.00.

- Russia (EAEU)→ 4010110000 / 4010120000 / 4010190000.

- Indonesia→11.00/4010.12.00/4010.19.00

I have prepared for you the official websites of the above countries’ customs hscode and tax rate inquiries, which are convenient and practical.

China | https://online.customs.gov.cn/ociswebserver/pages/jckspsl/index.html |

United States (HTSUS) | |

European Union (CN Code) | |

Japan | |

India | https://www.cbic.gov.in/ |

Brazil (Mercosur NCM) | https://www.receita.fazenda.gov.br/ |

Russia (EAEU) | http://www.eaeunion.org/ |

Indonesia | https://repository.beacukai.go.id/download/2022/03/a81ee0ea78c86940cd23317d089976d1-chapter-40.pdf |

3.3 Practical Implications

3.3.1 Tariff rates

- Steel cord belts (11) often face higher tariffs because they are high-value, heavy-duty products.

- Textile belts (12) usually enjoy lower duty rates.

- Kevlar belts (19) may fall under special tariff schedules because of their advanced aramid fibers.

3.3.2 Export rebates

- In China, rubber conveyor belts under HS Code 4010typically qualify for a 9% export rebate. Getting the subheading right ensures exporters receive this benefit without delays.

3.3.3 Documentation

- Customs clearance is smoother when invoices and contracts specify reinforcement. Writing “ST conveyor belt, steel cord carcass, no weft” or “EP conveyor belt, polyester warp and nylon weft” eliminates confusion and prevents reclassification.

3.4 Summary Table: Rubber Conveyor Belt Types and HS Codes

Conveyor Belt Type | Reinforcement (Warp/Weft) | HS Subheading | Example Products (Tiantie Industrial) |

ST Conveyor Belt | Warp: Steel cords / Weft: fabric, rubber, or none | 4010.11 | Steel Cord Conveyor Belt, Anti-Tear ST Belt, Pipe ST Belt |

EP Conveyor Belt | Warp: Polyester / Weft: Nylon | 4010.12 | Multi-ply EP Conveyor Belts |

NN Conveyor Belt | Warp: Nylon / Weft: Nylon | 4010.12 | NN Conveyor Belts for mining & ports |

SW Conveyor Belt | Straight warp fabric (single layer) | 4010.12 | SW Belts with high tear resistance |

CFW Conveyor Belt | Crawford weave textile | 4010.12 | CFW Belts with enhanced stability |

Kevlar Conveyor Belt | Warp: Kevlar fibers / Weft: Kevlar or aramid blend | 4010.19 | Kevlar-reinforced belts, lightweight & heat resistant |

4.PVC Conveyor Belt HS Code

When it comes to identifying the correct conveyor belt hs code, many companies run into confusion. Rubber conveyor belts are grouped under Chapter 40, but PVC conveyor belts do not belong there. Instead, they fall under Chapter 59 of the Harmonized System. The reason is straightforward: a PVC conveyor belt is essentially a fabric belt coated with plastic, and customs officials always classify products by their core material. The coating matters, but it does not define the HS Code.

Getting this distinction wrong can cause serious issues. Misreporting a PVC belt under 4010 may result in customs inspections, delayed shipments, and in China, even loss of the higher export rebate available for PVC belts. That’s why knowing the right pvc conveyor belt hs code is not just about paperwork—it’s about saving time and money in global trade.

4.1 Global 6-Digit Code with Product Categories

The HS Code for PVC conveyor belts is nested within Chapter 59, which covers industrial textiles. Let’s break it down step by step:

- 59→ This chapter deals with impregnated, coated, covered, or laminated textile fabrics, and also technical textiles used for industrial purposes. Since PVC belts start with a woven textile carcass, they are placed in this chapter rather than in plastics (Chapter 39) or rubber (Chapter 40).

- 5910→ This heading covers transmission or conveyor belts of textile material, whether or not they are coated with plastics such as PVC or PU, and whether or not they are reinforced with other materials like metal.

- 591000→ At this level, the classification narrows to conveyor belts of textile material, including those with plastic coatings. This is the precise code where customs worldwide places PVC and PU belts.

Understanding the conveyor belt hs code in this layered way helps exporters and importers avoid the mistake of declaring these belts as “plastic goods” or “rubber goods.” Customs always looks at the essential structure—in this case, textile reinforcement—when assigning classification.

4.1.1 PVC Conveyor Belts

- Warp (lengthwise):Polyester yarns, selected because they stretch very little and help the belt stay stable under load.

- Weft (crosswise):Polyester or cotton. Polyester strengthens the belt across its width, while cotton provides flexibility and helps the PVC layer adhere to the fabric.

With this structure, PVC belts combine stability with versatility. The PVC coating can be smooth, patterned, or embossed depending on the application. This explains why PVC belts are found in airports, parcel handling, logistics warehouses, and packaging lines.

4.1.2 PU Conveyor Belts

PU belts share the same textile carcass design as PVC belts but use polyurethane as the coating material.

- Warp (lengthwise):Polyester fibers to ensure dimensional stability.

- Weft (crosswise):Polyester or cotton, depending on the balance of rigidity and flexibility needed.

The PU coating is smoother and more resistant to oils and fats compared with PVC. This makes PU belts the standard choice for food-grade applications, such as bakeries, meat processing, and dairy production. From a customs perspective, though, they fall under the same plastic conveyor belt hs code of 5910.00, because the textile carcass remains the defining feature.

4.2 Country-Specific Classifications

Although the first six digits are globally uniform, each country extends the HS Code for its own tariff and reporting purposes:

- China→ 5910000000 (CIQ: 5910000000999).

- United States (HTSUS)→ 5910.00.1000 / 5910.00.2000.

- European Union (CN Code)→ 5910 00 00.

- Japan→ 5910.00.000.

- India→ 5910 00 00.

- Brazil (Mercosur NCM)→ 5910.00.00.

- Russia (EAEU)→ 5910000000.

Different countries may display the code with more or fewer digits, but the principle is the same: the correct pvc conveyor belt hs code begins with 5910.00.

4.3 Practical Implications

4.3.1 Customs Declaration

Many exporters mistakenly file PVC belts under 4010. Since the surface looks rubber-like, it is easy to confuse. But customs focuses on the carcass, and if it is textile, the product belongs under 5910. Misclassification often leads to inspections, additional paperwork, and sometimes penalties.

4.3.2 Tariffs and Duties

Duty rates under 5910 often differ from those under 4010. In certain regions, textile-based products may benefit from trade agreements, meaning PVC belts could face lower tariffs than rubber belts. Using the right conveyor belt hs code ensures importers calculate costs correctly.

4.3.3 Export Rebates

In China, PVC conveyor belts (5910) are eligible for a 13% export rebate, compared with only 9% for rubber belts. Misclassifying the product directly reduces the exporter’s refund and therefore their profit margin.

4.3.4 Documentation Best Practices

To avoid disputes, invoices and contracts should clearly state both material and structure. For example:

- “PVC conveyor belt, textile carcass, polyester warp / cotton weft, PVC coated.”

- “PU conveyor belt, polyester warp and weft, polyurethane surface.”

This level of clarity helps customs officers confirm the correct classification quickly.

4.3.5 Landed Cost for Buyers

Importers must use the right HS Code to calculate the total landed cost, which includes not only the duty rate but also VAT, local surcharges, and customs clearance fees. A mistake in HS classification can distort landed cost calculations, leading to unexpected expenses.

4.4 Summary Table: PVC and PU Conveyor Belts

Conveyor Belt Type | Reinforcement (Warp/Weft) | Coating | HS Subheading | Typical Applications |

PVC Conveyor Belt | Warp: Polyester / Weft: Polyester or Cotton | PVC layer (smooth, patterned, embossed) | 5910.00 | Logistics, airports, warehouses, packaging |

PU Conveyor Belt | Warp: Polyester / Weft: Polyester or Cotton | PU layer (food-grade, oil-resistant) | 5910.00 | Bakery, meat processing, dairy, food packaging |

5.Global Comparison of Conveyor Belt HS Codes

At first glance, the conveyor belt hs code looks simple: rubber belts belong to 4010, while PVC/PU belts fall under 5910. The first six digits are universal. The real complexity begins after digit six, where each country extends the code differently. Exporters who overlook this often face rejected entries—not because the classification is wrong, but because the digit format doesn’t match the importing country’s system.

5.1 HS Code Digit Formats by Country

Country / Region | Digits Used | Notable Feature |

China | 10 digits + 13-digit CIQ | CIQ extension mandatory for customs clearance and inspection. |

United States (HTSUS) | 10 digits | Splits belts into finer tariff lines, especially by reinforcement type. |

European Union (CN/TARIC) | 8 digits (CN) / 10 digits (TARIC) | CN is used on invoices, while TARIC provides detail for duties. |

Japan | 9 digits | Unique extension system, aligned with the WCO six-digit base. |

India | 8 digits | Similar to EU format; consistent in ITC-HS schedules. |

Brazil (Mercosur NCM) | 8 digits | Shared across Mercosur members, easing intra-bloc trade. |

Russia / EAEU | 10 digits | Standardized within the Eurasian Economic Union. |

Indonesia (ASEAN AHTN) | 8 digits | Follows ASEAN’s Harmonized Tariff Nomenclature, aligned regionally. |

5.2 What Exporters Should Keep in Mind

For global trade, the six-digit base classification is never disputed. What changes is the number of digits required locally. For example, a U.S. buyer may record 4010.12.9000, while an EU buyer lists 4010 12 00 for the same rubber belt. Indonesia, using the ASEAN 8-digit system, will format it differently again.

The key for traders is not only knowing the rubber conveyor belt hs code and the pvc conveyor belt hs code, but also double-checking the exact digit format in the destination country. A small oversight here can cause paperwork rejection, slow customs clearance, and miscalculated tariffs or rebates.

6.Tariff Rates, VAT, and Duty Drawbacks

Choosing the correct conveyor belt hs code is not just about compliance; it directly shapes the total landed cost of the shipment. Duties, VAT, and duty drawback programs all rely on the HS Code entered at customs. A single misclassification can therefore shift the cost structure for both exporters and importers.

6.1 Tariff Rates Across Markets

- United States: The Harmonized Tariff Schedule of the U.S. (HTSUS) applies specific duty rates depending on the HS Code extension.For example, rubber conveyor belts under 12 may face one rate, while textile-based PVC belts under 5910.00 fall into another. Importers often use these distinctions when planning procurement, since even a 2% difference in duty can reshape the economics of a long-term contract.

- European Union: The EU applies a Common Customs Tariffacross its member states, so once a product is classified (e.g., 4010 12 00 for rubber belts or 5910 00 00 for PVC belts), the duty is uniform across Germany, France, Italy, and others. This makes the EU attractive for centralized import hubs, but only if the HS Code is assigned correctly in TARIC.

- China: For imports, China Customs applies its own schedule based on the HS Code. But for exporters, the focus is different—export tax rebates depend entirely on correct classification. Rubber belts under 4010qualify for a lower rebate rate, while PVC belts under 5910 secure a higher one. Exporters who declare incorrectly effectively give up part of their margin.

6.2 VAT and Indirect Taxes

- EU VAT: Once goods clear customs, a value-added tax (typically 19–23% depending on the country) is applied to the CIF value plus duty. That means the HS Code not only affects the duty but also the VAT base. A higher duty rate increases the VAT amount payable.

- India and Indonesia: These markets also apply VAT or GST on imports, usually around 18% in India and 11% in Indonesia. Just like in the EU, VAT is calculated on the landed value, making accurate HS Code entry essential.

- China (domestic): Exporters benefit from VAT rebates linked to the HS Code. This is why the distinction between a rubber conveyor belt hs codeand a pvc conveyor belt hs code is not academic—it determines how much tax can be reclaimed.

6.3 Duty Drawbacks and Refunds

Many countries operate duty drawback schemes for exporters. In China, this is directly linked to the export rebate percentages. In the U.S., companies may claim a refund of duties paid if goods are re-exported without being consumed. The EU also has customs procedures like “inward processing relief,” where duties can be suspended or refunded depending on how the product is used.

These benefits are only accessible if the HS Code is correct. A shipment misdeclared under the wrong code may not qualify for drawback or rebate, even if it is eventually re-exported or processed under the right conditions.

6.4 Practical Takeaway for Traders

For buyers, landed cost is the real number that matters. It includes CIF value, duty, VAT, and clearance fees. For exporters, profit margin often depends on reclaiming tax through rebates or drawback. Both sides of the transaction rely on the same foundation: the HS Code.

That’s why traders should always confirm the conveyor belt hs code for each market. A rubber belt declared as PVC, or vice versa, not only risks fines but also throws off cost calculations. Correct codes mean accurate tariffs, predictable VAT, and access to the right drawback rates.

7.Common Mistakes in HS Code Classification

Even when the rules look clear, many companies still trip up when declaring the conveyor belt hs code. Most errors come from assumptions—looking at the surface material instead of the structural carcass, or copying codes from another country without checking the local format. Here are the pitfalls to avoid:

7.1 Misclassifying PVC as Rubber

A common mistake is reporting PVC conveyor belts under 4010 because the coating looks rubber-like. Customs, however, always checks the core. If the carcass is textile, the correct pvc conveyor belt hs code is under 5910. Filing it as rubber causes inspection delays and can disqualify exporters from the higher rebate rate.

7.2 Mixing Up Reinforcement Types

Within rubber belts, the reinforcement defines the subheading. Steel cord belts go to 4010.11, textile-reinforced belts go to 4010.12, and other special reinforcements are grouped under 4010.19. Mislabeling an EP or NN belt as “other” may trigger reclassification, extra duties, or even fines for misdeclaration.

7.3 Treating Light-Duty Belts as Heavy-Duty Rubber

Lightweight belts used in food-grade applications are often PVC or PU with textile carcasses. Declaring them as rubber conveyor belts creates immediate red flags, since their weight, texture, and structure don’t match. Importers then face clearance delays and sometimes seizure until the error is corrected.

7.4 Ignoring Format Differences

Some exporters simply copy a code from a foreign invoice—like a U.S. 10-digit format—and paste it into an EU customs form. Even if the six-digit base is correct, the wrong format leads to rejection. Always adjust the code to match the country’s required digit length.

7.5 Key Lesson for Exporters and Importers

The safest approach is to specify materials clearly in invoices and contracts—for example: “PVC conveyor belt, polyester warp, cotton weft, PVC coating”. With this detail, customs officers can verify classification quickly, reducing the chance of disputes.

Correctly identifying the rubber conveyor belt hs code or the pvc conveyor belt hs code is more than a technicality; it keeps trade moving smoothly and protects profit margins.

8.Guidance for Exporters and Importers

For anyone trading conveyor belts, knowing the correct conveyor belt hs code is not optional—it is a requirement. Wrong classification can mean penalties, missed rebates, or delayed shipments. The good news is that exporters and importers can follow a systematic approach to avoid errors.

Step 1: Confirm the Material

Start with the obvious. Is the belt made of rubber or of textile coated with plastic?

- If the carcass is rubber-based(with steel, nylon, or polyester reinforcement), the code belongs to 4010.

- If the carcass is textile-basedand coated with PVC or PU, then the product must be classified under 5910.

This first decision determines whether you should be searching for the rubber conveyor belt hs code or the pvc conveyor belt hs code.

Step 2: Identify the Reinforcement

For rubber belts, reinforcement defines the subheading.

- Steel cord belts→ 4010.11

- Textile reinforced belts (EP, NN, etc.)→ 4010.12

- Other reinforcements (Kevlar, specialty fibers)→ 4010.19

For PVC and PU belts, reinforcement is almost always textile (polyester warp, polyester or cotton weft). Customs still treats them as 5910.00, regardless of coating pattern or thickness.

Step 3: Check Both Export and Import Databases

Exporters must check their own customs database, while importers must check the destination country’s tariff schedule. The six-digit base will always match, but national extensions differ.

- China: China Customs HS Code Database

- United States: HTS Search at USITC

- European Union: TARIC Consultation

- India: ITC-HS Classification

- WCO: World Customs Organization

Always use the official site, not third-party blogs, to avoid outdated or inaccurate codes.

Step 4: Confirm with a Customs Broker or Official

Even when you are confident, it is wise to confirm with a licensed customs broker or directly with the customs office. Brokers can validate whether your product description matches the code in practice, which helps avoid reclassification at the port.

Step 5: Be Specific in Documentation

On invoices and contracts, always specify the materials and structure. Instead of writing only “conveyor belt,” use:

- “Rubber conveyor belt, steel cord reinforced, vulcanized rubber carcass”

- “PVC conveyor belt, polyester warp, cotton weft, PVC coated”

These details help customs officers validate the HS Code quickly and minimize delays.

Compliance Risks

Misreporting an HS Code can result in fines, shipment re-export, or loss of rebates. Some countries also record violations in a company’s compliance profile, which can raise inspection rates on future shipments. Correct classification protects both your reputation and your bottom line.

Practical Takeaway

Exporters should never assume one country’s format works everywhere. Importers should never base landed cost calculations on an unverified HS Code. Both sides benefit when the conveyor belt hs code is double-checked, confirmed, and clearly documented.

Correct steps today mean smoother customs tomorrow.

9.A Final Reminder on conveyor belt HS Code

After dealing with international trade for years, I’ve learned one thing: the conveyor belt hs code is never just a number. It’s the difference between smooth clearance and weeks of delay, between getting your rebate or watching profit vanish.

For rubber belts, the code always comes back to 4010. For PVC or PU belts, it’s 5910. This distinction might look minor, but anyone who has had a shipment held at customs knows how expensive a “small mistake” can be. In China alone, misreporting means giving up the 13% rebate for PVC belts and settling for the lower 9% for rubber belts.

I’ve seen buyers and exporters get tripped up not because they didn’t know the product, but because they copied the wrong format from another country’s invoice. A U.S. ten-digit code won’t work in Europe, and a Chinese shipment needs the extra CIQ extension. These details sound trivial—until your goods are stuck at the port.

So here’s the takeaway: always double-check the rubber conveyor belt hs code or the pvc conveyor belt hs code for the market you’re working with. Write the materials clearly on your invoice, match the digit format to the destination, and don’t assume customs will “understand what you mean.” Precision is boring, but in trade it pays off.